The UP World LNG Shipping Index (UPI) rose 0.67% to 168.40 points, while markets remained quiet despite geopolitical shifts made by the new U.S. administration, reports UPI analyst Tomas Novotny. “This can

The UP World LNG Shipping Index (UPI) rose 0.67% to 168.40 points, while markets remained quiet despite geopolitical shifts made by the new U.S. administration, reports UPI analyst Tomas Novotny. “This can potentially increase LNG market competition, leading to lower prices but higher sales.”

The UPI saw moderate growth, with Awilco LNG (+9.1%), BP (+8.5%), and Cool Company (+6.8%) among the top gainers, while Tsakos Energy (-5.2%) and Capital Clean Energy (-4.9%) declined. Many stocks are nearing key resistance levels, hinting at possible breakouts. In the short term, volatility is expected to rise, but the long-term outlook remains positive, driven by LNG demand growth and potential new contracts.

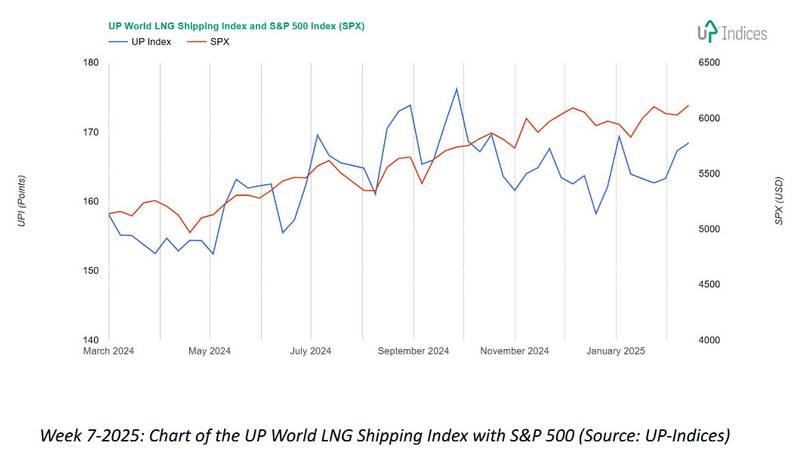

The UP World LNG Shipping Index (UPI), which tracks listed LNG shipping companies, gained 1.13 points (0.67%), closing at 168.40 points, while the S&P 500 index rose by 1.47%.

The past week has been quiet on the stock markets, even though forces weakening international co-operation are in motion. “Of course, we are referring to the administration of the new US President, who is going hard after his own. This shift may be positive for the LNG shipping sector, as it will increase competition in the LNG market, bringing prices

Content Original Link:

" target="_blank">