Shipping Stock Market: Weekly Update

The container shipping sector continues to navigate a dynamic landscape shaped by shifting freight rates, global economic conditions, and supply chain developments. Investor sentiment remains mixed as companies balance operational efficiency with market volatility. While some firms benefit from stable long-term charters, others face pressure from fluctuating spot rates and macroeconomic uncertainties. The ongoing adjustments in capacity management, fuel costs, and geopolitical factors further contribute to stock price movements. As global trade patterns evolve, shipping companies must adapt to changing demand across major trade lanes. With economic indicators offering both risks and opportunities, the sector’s performance remains under close scrutiny by investors.

See below the major companies’ stock performance this week:

- SITC International Holdings Co Ltd (1308) – HK$

SITC International’s stock has shown a consistent downward trend, declining from HK$18.06 to HK$17.3 over the week. This suggests mild bearish sentiment, possibly driven by softer demand in intra-Asia trade or cost pressures from fuel prices. Investors may be cautious as the stock struggles to find support. However, given SITC’s strong regional network, any macroeconomic stabilization in China could offer a turnaround opportunity.

- Yang Ming Marine Transport Corp (2609) – NT$

Yang Ming’s stock fluctuated between NT$71.2 and NT$71.7, indicating relative stability despite market volatility. This could be attributed to resilient demand in transpacific trade lanes or controlled capacity management. Investors are likely monitoring freight rate movements closely, as any uptrend in spot rates could provide an upside catalyst for the stock.

- Evergreen Marine Corp Taiwan Ltd (2603) – NT$

Evergreen Marine saw fluctuations, peaking at NT$218 before dipping to NT$213.5. This minor pullback might reflect short-term profit-taking or adjustments following recent rate changes in Asia-Europe and transpacific routes. The company remains well-positioned, but further pressure from softening demand or increasing capacity could weigh on stock performance.

- Wan Hai Lines Ltd (2615) – NT$

Wan Hai’s stock hovered between NT$84.2 and NT$85, indicating minor movements but no clear directional shift. The intra-Asia specialist remains sensitive to regional demand and fuel costs, and investors will be watching for any signs of rate improvements. If consumer demand in China and Southeast Asia strengthens, Wan Hai could benefit in the coming months.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY) – US$

COSCO’s price slipped from US$8.14 to US$7.9, reflecting mild bearish sentiment. Geopolitical tensions, potential regulatory pressures, and rate fluctuations may be influencing investor sentiment. However, COSCO remains a key player in global shipping, and any rebound in global trade could help stabilize the stock.

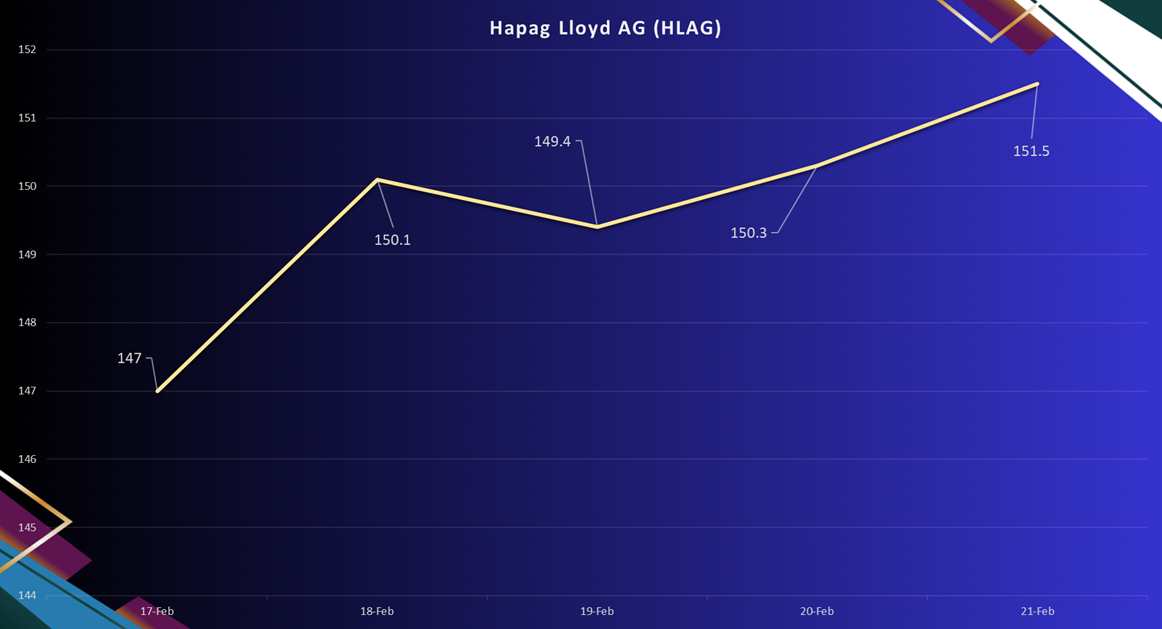

- Hapag-Lloyd AG (HLAG) – €

Hapag-Lloyd exhibited a slight uptrend, rising from €147 to €151.5. This suggests investor confidence, possibly driven by robust earnings and stable freight rates. The European liner company remains a strong player, though global economic uncertainty and demand shifts could create volatility in the near term.

- ZIM Integrated Shipping Services Ltd (ZIM) – US$

ZIM saw an upward trend from US$19.85 to US$20.82, indicating positive momentum. This could be due to improving freight rates, strategic capacity management, or optimistic earnings expectations. However, ZIM’s high exposure to volatile rate changes means investors should remain cautious about potential fluctuations.

- AP Moeller-Maersk AS (AMKBY) – US$

Maersk’s stock edged up from US$8.5 to US$8.72, reflecting cautious optimism in the container shipping sector. The company’s strategic focus on integrated logistics and cost control may be supporting investor confidence. However, macroeconomic uncertainties, particularly in Europe and Asia, could impact demand for global shipping in the near term.

- Matson Inc (MATX) – US$

Matson’s stock declined from US$149.06 to US$142.82, suggesting selling pressure amid market volatility. As a key player in U.S. domestic and Pacific trade lanes, Matson remains exposed to fluctuating consumer demand. Investors may be reacting to concerns over softening freight rates or economic headwinds affecting transpacific trade.

- Orient Overseas International Ltd (0316) – HK$

OOIL’s stock saw a slight drop from HK$109.9 to HK$108, indicating mild bearish sentiment. The company’s exposure to Asia-Europe and transpacific trade routes makes it sensitive to global economic trends. Investors may be awaiting clearer signals on freight rate stability and demand recovery before making major moves.

- Danaos Corporation (DAC) – US$

Dnaos fluctuated between US$83.77 and US$85.73, reflecting volatility in the containership leasing market. As a major shipowner, Danaos benefits from long-term charter contracts but remains exposed to shifts in vessel demand and charter rates. Recent movements suggest investors are weighing potential upside from stable lease agreements against broader market risks.

- Mitsui O.S.K. Lines, Ltd. (9104) – ¥

Mitsui O.S.K. Lines saw minor fluctu ations, peaking at ¥5,540 before retreating to ¥5,426. The Japanese shipping giant remains a key player in bulk, LNG, and container shipping, but investors are likely cautious about external factors such as global trade tensions and fuel costs. Further shifts in freight rates will be crucial in determining the stock’s direction.

- Nippon Yusen K.K (9101) – ¥

Nippon Yusen’s stock fluctuated between ¥5,185 and ¥5,257, showing slight volatility with a downward bias. As one of Japan’s largest shipping companies, it remains sensitive to global trade conditions and fuel costs. Investors may be reacting to mixed freight rate trends and economic uncertainty, though strong LNG shipping demand could offer long-term stability.

- HMM Co Ltd (011200) – ₩

HMM’s stock showed an upward trajectory, climbing from ₩18,100 to ₩18,730 before settling slightly lower. This suggests positive sentiment, likely driven by improving freight rates or operational efficiencies. However, investor caution remains due to market-wide volatility and potential supply-demand imbalances in global container shipping.

- Kawasaki Kisen Kaisha, Ltd. (9107) – ¥

“K” Line’s stock trended downward from ¥2,156 to ¥2,104, reflecting mild bearish sentiment. The company’s diversified shipping portfolio, including bulk carriers and LNG, provides resilience, but investors are likely wary of short-term rate fluctuations. A rebound in global demand could stabilize the stock.

- Pan Ocean Co Ltd (028670) – ₩

Pan Ocean showed steady gains, rising from ₩3,515 to ₩3,740. As a key player in bulk shipping, the company is benefiting from stable demand for dry bulk commodities like grain and coal. Continued strength in global trade could support further gains, though external risks such as geopolitical instability remain factors to watch.

- Ningbo Ocean Shipping Co Ltd (601022) – ¥

Ningbo Ocean’s stock remained relatively stable, ranging between ¥7.79 and ¥7.92. The Chinese shipping firm’s performance suggests investor caution amid uncertain demand in domestic and regional trade. Any signs of recovery in China’s manufacturing and exports could provide a boost to the stock.

- MPC Container Ships ASA (MPCC) – NOK

MPC Container Ships saw an increase from NOK 18.51 to NOK 19.32, indicating bullish sentiment. The company, focused on regional and feeder container services, is benefiting from stable charter rates. Investors are likely optimistic about continued demand for smaller vessel segments, though rate fluctuations could impact momentum.

- SFL Corporation Ltd (SFL) – US$

SFL Corporation’s stock declined from US$9.71 to US$9.39, reflecting mild bearish sentiment. As a diversified shipping lessor with exposure to tankers, bulk carriers, and containerships, SFL remains sensitive to fluctuations in charter rates and global shipping demand. Investors may be reacting to broader market uncertainty, though the company’s long-term contracts provide stability.

- Costamare Inc (CMRE) – US$

Costamare’s stock showed minor fluctuations, ranging from US$10.61 to US$10.46 before rebounding slightly. As a major containership owner, Costamare benefits from long-term charter agreements, reducing exposure to volatile spot rates. Investors appear to be waiting for clearer signals on freight market direction before making significant moves.

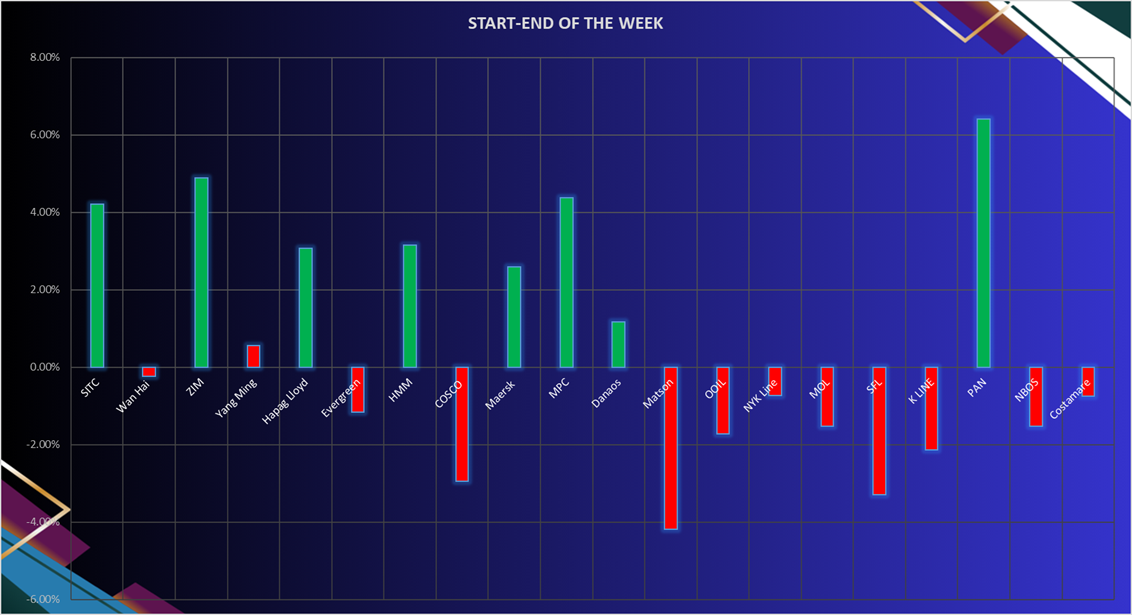

The shipping sector exhibited a mixed performance this week, with notable divergences across key companies. While some carriers posted solid gains, others faced downward pressure due to fluctuating freight rates, macroeconomic uncertainties, and investor sentiment.

SITC, ZIM, Hapag-Lloyd, HMM, Maersk, MPC, and Pan Ocean showed positive momentum, with Pan Ocean leading the pack, reflecting strong bulk shipping demand. In contrast, major players like COSCO, Matson, OOIL, NYK Line, MOL, “K” Line, SFL, Ningbo Ocean, and Costamare saw declines, suggesting ongoing challenges in global trade and rate volatility. Companies with strong long-term contracts and diversified fleets remained relatively stable, while those more exposed to the spot market saw greater fluctuations. Fuel costs, geopolitical developments, and shifts in demand will continue to shape market movements in the coming weeks. Investors will be closely monitoring freight rates and economic indicators to gauge the sector’s short-term trajectory.

![]()

The post Shipping Stock Market: Weekly Update appeared first on Container News.

Content Original Link:

" target="_blank">