Drewry: US-Europe tensions may shift LNG trade dynamics

The global LNG market is at a critical point, with geopolitical changes between the US and Europe bringing new factors into established trade patterns, according to Drewry.

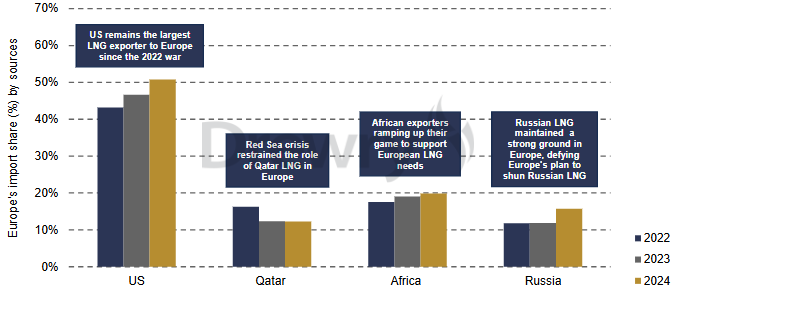

While the US has dominated European LNG imports since the Russia-Ukraine war, Europe may adopt a diversification strategy to hedge against future supply uncertainties, Drewry highlights. This shift could have significant implications for shipping demand and trade routes, potentially unlocking new opportunities for the LNG industry.

Europe’s growing dependence on US LNG

The US became Europe’s largest LNG supplier in 2022, following the shift away from Russian pipeline gas. If the second Trump presidency imposes tariffs on European imports, the continent would likely retaliate by reducing reliance on US energy. This would compel European buyers to seek alternative LNG sources, increasing long-term contracts with Qatar, Africa, and even Russia despite ongoing sanctions.

Drewry pointed out that while the US LNG supply will not disappear from Europe, a decline in its market share will shift global trade flows, impacting LNG shipping demand.

Europe has been working to diversify its energy sources, but limited spot LNG availability and disruptions in the Red Sea have kept US LNG as the dominant supply. While African producers like Nigeria, Algeria, and Angola contribute, their production constraints limit their share in Europe.

Moreover, in 2025, new supply agreements with Qatar and African producers are expected to further lessen US LNG dominance. However, Southern Europe faces infrastructure bottlenecks, with countries like Italy and Spain relying on Turkey as a transit hub. As NATO relations shift, Turkey may become a key LNG gateway for Europe.

Rising US-Europe tensions introduce new considerations for LNG market participants

While US-Europe trade tensions will disrupt LNG flows, they will also create new opportunities for shipping. Furthermore, US LNG will continue to play a central role in European energy security through 2025, a gradual shift towards diversification is likely.

Furthermore, the expected shift of European buyers towards Qatar, Africa and Russia will increase voyage distances, while US exporters will pivot to Asia, boosting tonne-mile demand. In the short term, market uncertainties and vessel surplus may weigh on freight rates, but structural changes in trade flows point to a stronger LNG shipping market in the long run.

The evolving landscape will demand adaptability as market participants navigate shifts in trade patterns and supply diversification efforts.

By adapting to these shifts, LNG shipping companies can position themselves to capitalise on emerging trade patterns, ensuring long-term profitability in an evolving global energy landscape.

Content Original Link:

" target="_blank">