The container shipping sector faced a turbulent week, with most major players witnessing a decline in their stock prices. This downturn could be indicative of broader economic concerns, shifts in global trade patterns, or specific challenges within the shipping industry itself.

Let’s delve into the performance of each company:

- SITC International Holdings Co Ltd (1308)

SITC International Holdings Co Ltd experienced a notable decline over the week, starting at 21.5 HK$ and ending at 19.84 HK$. This represents a decrease of 7.72%, suggesting a challenging period for the company amidst possibly volatile market conditions. The week’s trajectory points towards investor caution or sector-specific issues impacting SITC.

- Wan Hai Lines Ltd (2615)

Wan Hai Lines Ltd saw its stock price drop from 84.5 NT$ to 80.9 NT$, a reduction of 4.26%. The consistent downward trend throughout the week indicates potential investor concerns or broader market influences affecting the container shipping sector. This performance might reflect broader economic trends or specific operational challenges.

- ZIM Integrated Shipping Services Ltd (ZIM)

ZIM Integrated Shipping Services had a minor fluctuation, starting at $21.45 and ending at $20.72, with the performance resulting in a 3.40% drop. This might reflect cautious trading in light of recent industry news or economic forecasts. ZIM’s slight downturn could be part of a larger pattern affecting shipping stocks.

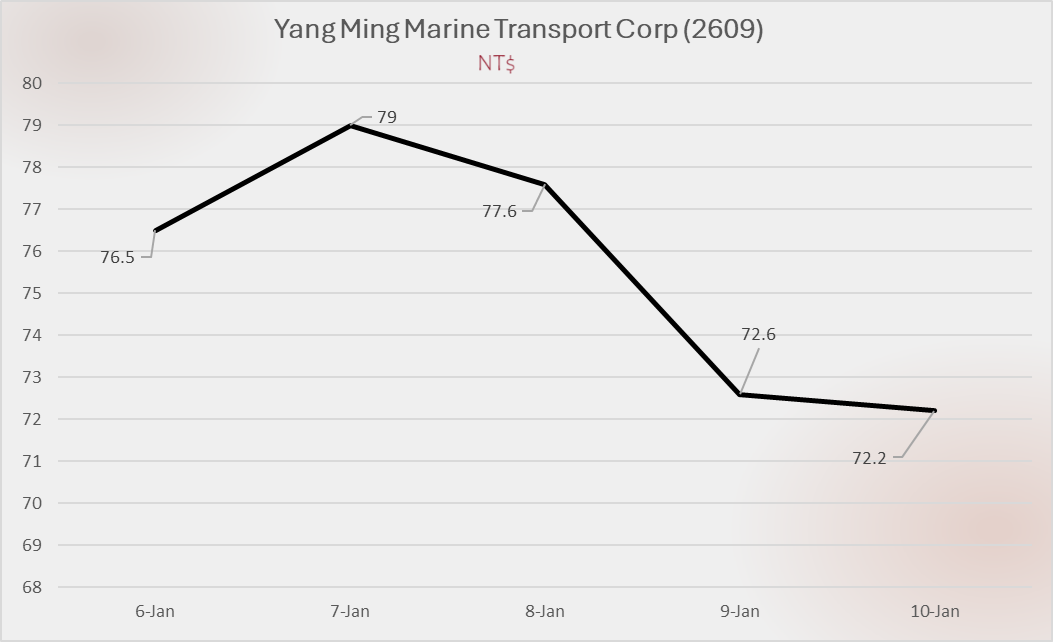

- Yang Ming Marine Transport Corp (2609)

Yang Ming’s shares decreased significantly from 76.5 NT$ to 72.2 NT$, witnessing a 5.62% decline. The sharp drop, especially towards the end of the week, could signal worries about capacity or freight rates in the sector. This performance might indicate a broader market correction or specific operational challenges for Yang Ming.

- Hapag-Lloyd AG (HLAG)

Hapag-Lloyd’s stock took a considerable hit, moving from €160.8 to €144.5, indicating a 10.14% loss. This major decline might be attributed to a combination of operational challenges or macroeconomic factors impacting the shipping industry. The steep drop suggests significant concern among investors.

- Evergreen Marine Corp Taiwan Ltd (2603)

Evergreen Marine Corp’s stock fell from 229.5 NT$ to 214 NT$, a 6.75% decrease. This downward trajectory might be influenced by similar industry-wide pressures or specific company-related issues. Evergreen’s performance could be indicative of broader market sentiments or specific company challenges.

- COSCO Shipping Holdings Co. Ltd ADR (CICOY)

COSCO Shipping Holdings saw a slight decrease from $8.03 to $7.76, translating to a 3.36% decline. Although less severe compared to its competitors, COSCO’s decrease still reflects a cautious week for investors.

- AP Moeller-Maersk AS (AMKBY)

AP Moeller-Maersk’s shares went from $8.43 to $8.02, marking a 4.86% decline. This could be indicative of broader market trends or specific challenges within the company’s operational areas.

- HMM Co. Ltd (011200)

HMM Co. Ltd’s stock prices showed minimal variations, starting and ending at 18,900 KRW. This stability could be seen as a positive amidst a generally declining market for shipping stocks. HMM’s flat performance stands out, possibly indicating a unique position or strategic resilience in the face of sector challenges.

General Performance Overview

This week, major container shipping companies experienced an overall downward trend in stock performance. Hapag-Lloyd saw the steepest decline at 10.14%, with SITC and Evergreen also facing significant drops of 7.72% and 6.75% respectively. Other companies like Wan Hai, ZIM, Yang Ming, COSCO, and Maersk also declined, though by less severe percentages. Interestingly, HMM managed to maintain its stock price, indicating perhaps a different set of market dynamics or investor confidence in this particular firm. The collective performance suggests possible concerns over shipping demand, costs, or a broader economic slowdown affecting the sector.

The post Weekly Market Review: Container Shipping Stocks appeared first on Container News.

Sidebar

Infomarine.Net Menu

Infomarine On-Line Maritime News

Today Maritime News Worldwide

Infomarine On-Line Maritime News

Today Maritime News Worldwide

24

Fri, Jan