The container shipping industry experienced a dynamic week, shaped by macroeconomic trends, geopolitical events, and trade dynamics. Volatility in fuel prices, shifts in demand patterns, and global supply chain adjustments all played significant roles in influencing the stock prices of major players.

While some companies faced declining stock values, others demonstrated resilience, reflecting their strategic positioning and operational strengths. Here’s a breakdown of the highlights and influencing factors for key companies:

- SITC International Holdings Co. Ltd (1308)

SITC’s stock performance saw fluctuations between HK$19.88 and HK$20.15 this week, closing lower at HK$19. Despite relatively stable trade volumes in the Asia-Pacific region, the company faced headwinds due to subdued export demand from China. This decline aligns with a broader trend of weakened trade activity in key Asian economies. Additionally, concerns over rising operational costs and slower-than-expected recovery in manufacturing output further pressured SITC’s valuation. The company ended the week with a notable 3.92% drop, reflecting a cautious sentiment among investors.

- Wan Hai Lines Ltd (2615)

Wan Hai’s stock traded between NT$77.9 and NT$78.4, settling at NT$76.6 by week’s end. The company has been navigating a challenging environment characterized by softening freight rates and intensified competition in intra-Asia routes. Geopolitical uncertainties in the South China Sea have also contributed to operational complexities, influencing market sentiment. Wan Hai recorded a modest 1.67% decline, underscoring investor concerns about its ability to sustain profitability amidst these headwinds.

- ZIM Integrated Shipping Services Ltd (ZIM)

ZIM’s stock experienced a significant drop from US$18.3 to US$16.62, marking a sharp 9.18% decline over the week. This decline is largely attributed to weaker Transpacific trade volumes and falling spot freight rates. The company’s reliance on routes heavily impacted by US import demand contributed to investor skepticism. Furthermore, rising fuel costs and reduced operating margins amplified the downward pressure on ZIM’s stock price. Market analysts are closely watching ZIM for signs of stabilization in its key markets.

- Yang Ming Marine Transport Corp (2609)

Yang Ming’s shares ranged from NT$69.9 to NT$72, closing at NT$68.8, a 1.57% weekly decline. The company has been facing challenges due to fluctuating demand for containerized goods and increasing competition in East-West trade lanes. Persistent concerns about overcapacity in the shipping industry also weighed on investor confidence. However, Yang Ming’s diversified fleet and strategic partnerships may provide some cushion against market volatility in the coming weeks.

- Hapag-Lloyd AG (HLAG)

Hapag-Lloyd’s stock moved between €143 and €145.3 early in the week but closed significantly lower at €132.5, registering a steep 7.34% decline. Weak European export data and growing concerns about economic stagnation in the Eurozone have dampened market optimism. Additionally, the company faced challenges from rising costs related to environmental compliance and slower growth in long-haul trades. Despite these hurdles, Hapag-Lloyd’s focus on premium services and digital transformation remains a key long-term strength.

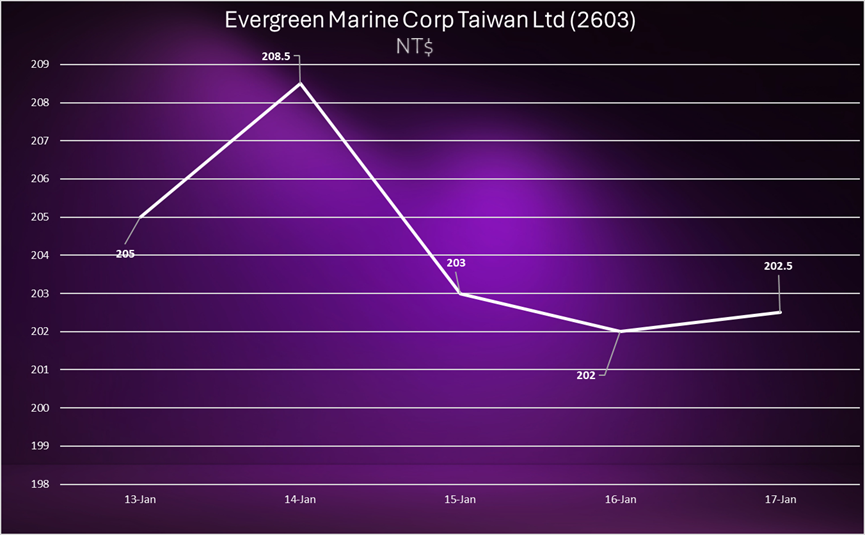

- Evergreen Marine Corp Taiwan Ltd (2603)

Evergreen Marine’s shares fluctuated between NT$205 and NT$208.5 before settling at NT$202.5, reflecting a mild 1.22% decline. The company benefited from robust intra-Asia trade flows but faced pressure from declining freight rates in global markets. Evergreen’s continued investment in fleet modernization and operational efficiency is likely to support its resilience in the face of broader market challenges.

- COSCO Shipping Holdings Co. Ltd ADR (CICOY)

COSCO’s stock moved in a narrow range, trading between $7.3 and $7.56, closing at $7.53 with a weekly gain of 3.15%. This positive performance can be attributed to strong growth in China’s domestic shipping market and the company’s effective cost management strategies. However, the market remains cautious about the potential impact of geopolitical tensions on COSCO’s international operations.

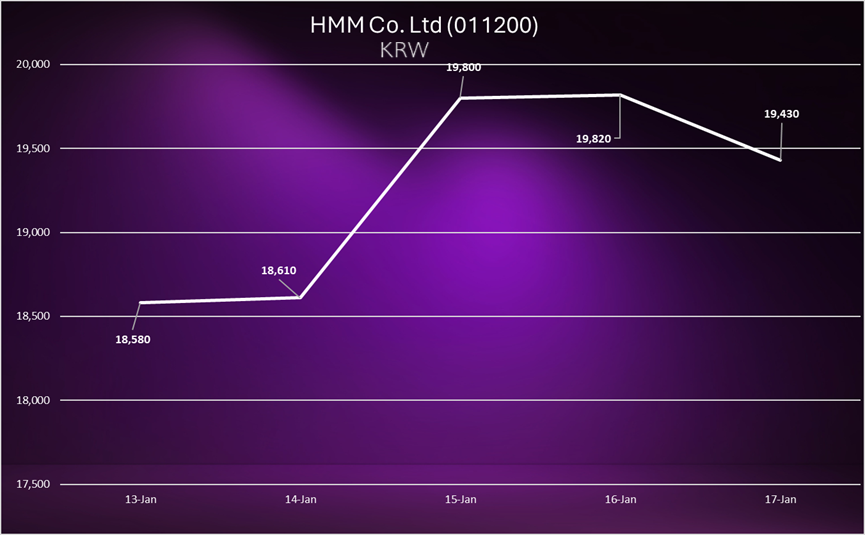

- HMM Co. Ltd (011200)

HMM experienced a strong week, with its stock climbing from KRW 18,580 to KRW 19,820 before settling at KRW 19,430, marking a robust 4.57% increase. This growth was driven by higher demand in long-haul routes and improved profitability from its premium services. HMM’s strategic investments in green technology and advanced logistics solutions have also bolstered investor confidence, setting the company apart in a challenging market environment

- AP Moeller-Maersk AS (AMKBY)

Maersk’s stock showed stability, fluctuating between US$7.26 and US$7.36 before ending the week at US$7.28, a marginal gain of 0.28%. As a global shipping leader, Maersk’s diversified revenue streams helped offset weaknesses in certain trade lanes. The company’s focus on integrated logistics and digitization has positioned it well to navigate ongoing market disruptions. Despite a flat performance, Maersk’s strong fundamentals continue to attract investor interest.

Weekly Summary

This week, the container shipping sector witnessed a mixed performance, with global economic uncertainties and regional dynamics shaping individual company outcomes.

Notable gainers included HMM (+4.57%) and COSCO (+3.15%), while ZIM (-9.18%) and Hapag-Lloyd (-7.34%) experienced significant declines. SITC (-3.92%) and Evergreen (-1.22%) faced moderate pressures, while Maersk’s (+0.28%) and Wan Hai’s (-1.67%) stability reflected cautious optimism.

Overall, the market reflects the sector’s continued adaptation to complex global challenges, highlighting the resilience and strategic differentiation of key players.

The post Stock Market Moves: Weekly Performance of Major Ocean Carriers appeared first on Container News.

Sidebar

Infomarine.Net Menu

Infomarine On-Line Maritime News

Today Maritime News Worldwide

Infomarine On-Line Maritime News

Today Maritime News Worldwide

24

Fri, Jan