Global Petroleum, an AIM-listed oil and gas upstream exploration company presently focused on Africa and the

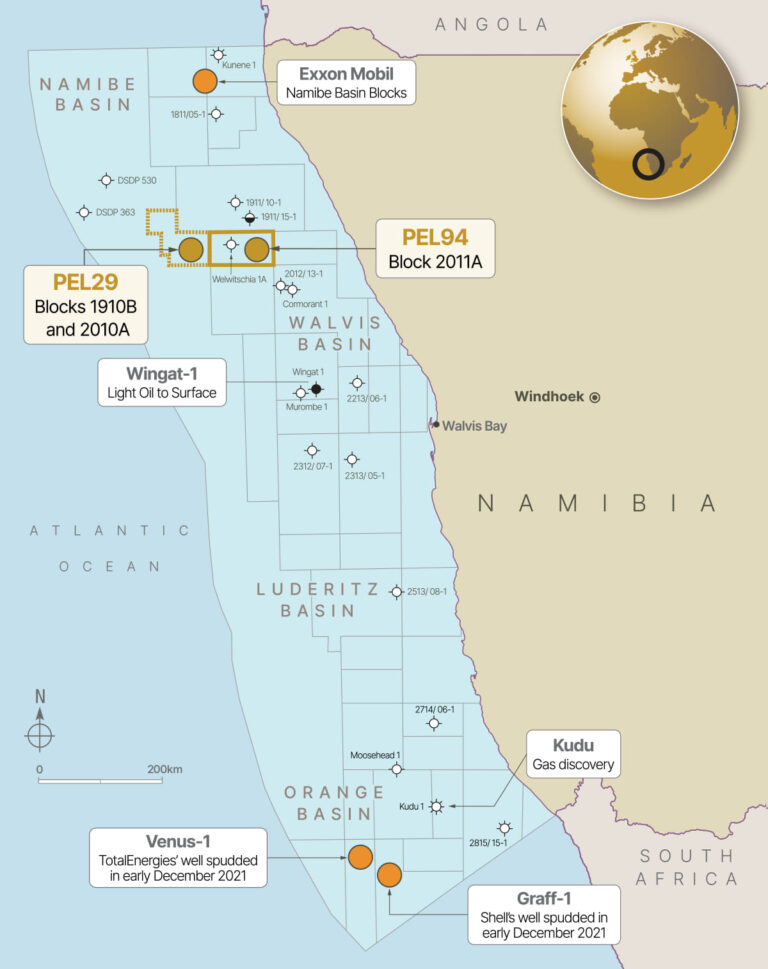

Global Petroleum, an AIM-listed oil and gas upstream exploration company presently focused on Africa and the Mediterranean, has decided to prolong its previous timeline to secure a farm-in agreement with a potential operating partner for its petroleum exploration license (PEL) 94 in Block 2011A in the Walvis Basin, off the coast of Namibia.

Following the initial set of hydrocarbon discoveries, Namibia continued its rise to exploration hotspot stardom, enabling Global Petroleum to catch the eye of undisclosed companies perceived to be ‘well-known’ in the oil and gas arena as the search for a partner in PEL 94 went on.

While early commercial discussions with an unnamed potential partner were confirmed in August 2024, the AIM-listed firm decided to extend the previously set deadline that aimed to conclude a farm-out deal by December 31, 2024.

While the company highlights that the farm-out transaction is progressing well, with all parties working diligently towards a successful conclusion, it also reports “renewed and new interest from several well-known companies in the oil and gas industry,” which is interpreted to underscore the attractiveness of PEL 94 and the firm’s strategic position in the market.

“Our priority is to evaluate all available options thoroughly, without being constrained by a strict timeline. By doing so, we aim to achieve the most advantageous terms and conditions for the company and its shareholders,” emphasized Global Petroleum.

Related Article

However, the AIM-listed player still underlines that it aims to conclude the transaction at the earliest opportunity with the most beneficial terms for the company and its shareholders. This license covers 5,798 square kilometers in water depths ranging from 450 to 1,550 meters.

Namibia’s state-owned NAMCOR has a 17% carried interest in PEL 94, and a private company, Aloe Investments Two Hundred and Two, has a 5% carried interest. A strategic partner is anticipated to potentially enable the exploitation of the estimated 2,747 billion barrels of oil on the license as part of unrisked net best estimate (P50) prospective resources.

Omar Ahmad, CEO of Global Petroleum, commented: “We are committed to exploring all opportunities and secure the best possible deal for our shareholders. The renewed and new interest from well-known companies is a testament to the potential of PEL 94.

“This strategic decision allows us to achieve the most beneficial outcome for the company. We appreciate the patience and support of our shareholders as we continue to work on this important transaction.”

While Namibia’s offshore arena continues to attract attention, offering the promise of more hydrocarbons, as is usual in the offshore drilling game, all exploration activities do not always yield the anticipated result, with some ending up being a miss while another drilling gig turns to be a hit.

This was confirmed recently by two oil majors, Shell and Chevron, respectively. Harmattan Energy, an indirect subsidiary of Chevron, drilled an exploration well in Namibia’s Orange Basin, which did not lead to commercial hydrocarbon quantities.

Related Article

-

Chevron ends in the same boat as Shell with no commercial hydrocarbons off Namibia

Exploration & Production

On the other hand, Shell decided to write down $400 million, citing technical and geological difficulties encountered at PEL 39, as the European energy giant could not confirm its oil discovery in the Orange Basin for commercial development at that stage.

Content Original Link:

" target="_blank">