Stock Monthly Report of Major Container Shipping Companies

In January 2025, the container shipping industry navigated through a storm of significant financial downturns, with major companies across the sector reporting notable stock losses. This period highlighted the vulnerability of the industry to various external pressures, including market overcapacity, geopolitical disruptions, and looming economic slowdowns.

As the sector grappled with these challenges, the resilience and strategic responses of these shipping giants became focal points of interest, setting the stage for a deeper analysis of their performance and the broader implications for the global shipping market.

- SITC International Holdings Co Ltd (1308)

SITC International’s stock saw a peak at HK$21.5 early in January before entering a downward trend. It declined to HK$18.44 by January 23, followed by a slight recovery to HK$18.6 at the end of the month. The overall movement reflects volatility in the shipping sector, with investors monitoring whether the stock will stabilize or face further pressure.

- Yang Ming Marine Transport Corp (2609)

Yang Ming Marine Transport Corp (2609) experienced a notable decline in its stock price over the past month. Starting at NT$76.6 in early January, the price peaked at NT$79 before entering a downward trend, closing at NT$67.8 by January 22. This decline reflects market fluctuations and potential industry challenges. Investors will be watching closely to see if the stock stabilizes or continues its descent in the coming weeks.

- Wan Hai Lines Ltd (2615)

Wan Hai Lines started January at NT$83.6, climbing to NT$84.7 before a sharp decline to NT$74 by January 20. However, the stock rebounded slightly, closing at NT$76.7. This fluctuation suggests uncertainty in the market, with potential recovery signals emerging. Investors will be watching closely for future trends.

- Evergreen Marine Corp Taiwan Ltd (2603)

Evergreen Marine Corp Taiwan Ltd (2603) experienced a volatile month in January 2025. Starting at NT$227 on January 2, the stock saw a sharp decline to NT$205 by January 13, followed by a slight recovery to NT$202.5 by January 17. The price dipped further to NT$199.5 on January 20 before rebounding to NT$204.5 by January 22. This fluctuation might reflect broader market conditions or specific challenges within the shipping sector, with investors closely watching for further developments.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

COSCO SHIPPING Holdings started the period at $8.2 before declining to $7.22, marking a significant drop. The stock then showed some recovery, reaching $7.72, but dipped again to $7.42 before slightly rebounding to $7.51. This fluctuation reflects ongoing market volatility, with investors watching closely for signs of stability or further movement.

- Hapag Lloyd AG (HLAG)

Hapag Lloyd AG (HLAG) saw a slight decline in its stock price throughout most of January 2025. Starting at €162.3 on January 2, the price decreased steadily, reaching €143 by January 13. The downward trend continued to €131 by January 17 before stabilizing around €130.7 by January 24. Towards the end of the month, there was a minor recovery, with the stock closing at €134.7 on January 29. This movement might reflect broader economic trends or specific issues within the shipping industry, with investors keeping an eye on future developments.

- ZIM Integrated Shipping Services Ltd (ZIM)

ZIM’s stock saw a sharp decline from $23.31 to $18.3, followed by a further drop to $16.64. A brief recovery to $17.06 was short-lived, as the stock slightly dipped again to $16.89. This downward trend highlights ongoing challenges in the shipping sector, with investors closely monitoring whether ZIM can regain momentum.

- AP Moeller-Maersk AS (AMKBY)

Maersk’s stock started at $8.52 before experiencing a steady decline to $7.48 and then further dropping to $7.08. A slight rebound to $7.28 was followed by another dip to $7.14, reflecting ongoing volatility in the shipping industry. Investors will be watching closely to see if the stock stabilizes or continues its downward trend.

- HMM Co Ltd (011200)

HMM’s stock showed an initial upward trend, rising from KRW 17,700 to a peak of KRW 19,820. However, it then dropped to KRW 18,050 before slightly recovering to KRW 18,640. This fluctuation indicates market uncertainty, with investors closely watching for potential stabilization or further shifts in the coming weeks.

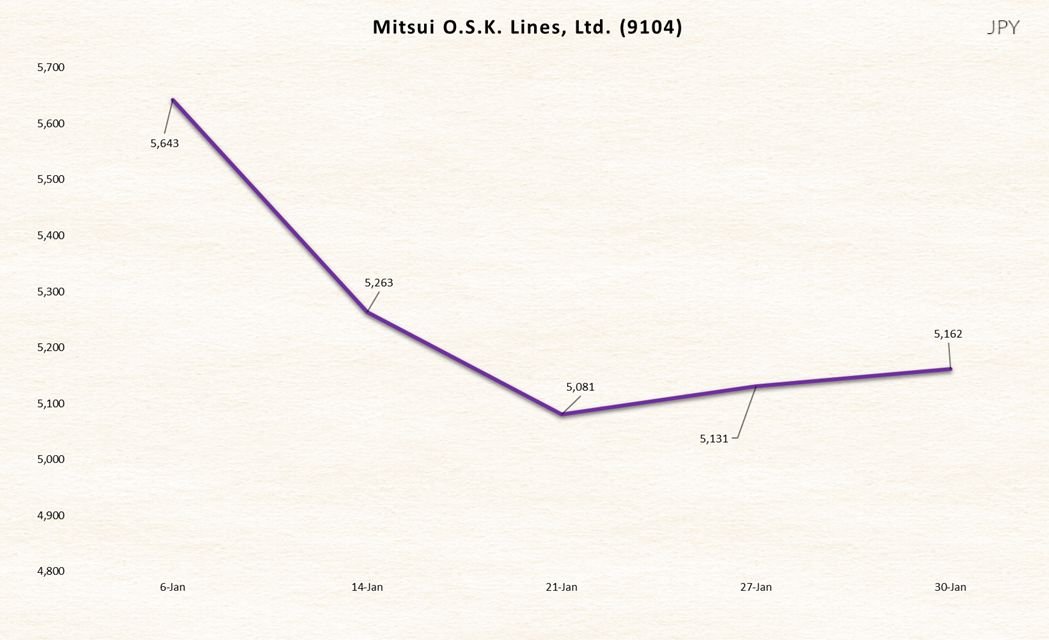

- Mitsui O.S.K. Lines, Ltd. (9104)

Mitsui O.S.K. Lines, Ltd. (9104) showed a mixed performance in January 2025, starting at ¥5,643. The stock fell to ¥5,263, then to ¥5,081, before a slight uptick to ¥5,131, and closing at ¥5,162. This fluctuation suggests the stock was influenced by various factors, possibly including company news or economic conditions, with investors monitoring for any sustained upward or downward trends.

- Nippon Yusen K.K (9101)

Nippon Yusen K.K (9101) had a downward trend in January 2025, beginning at ¥5,340. The stock price decreased to ¥5,062, then to ¥4,742 before slightly recovering to ¥4,832. It ended the month at ¥4,813. This decline could be attributed to market adjustments or sector-specific issues, with investors looking for indications of stabilization or further declines.

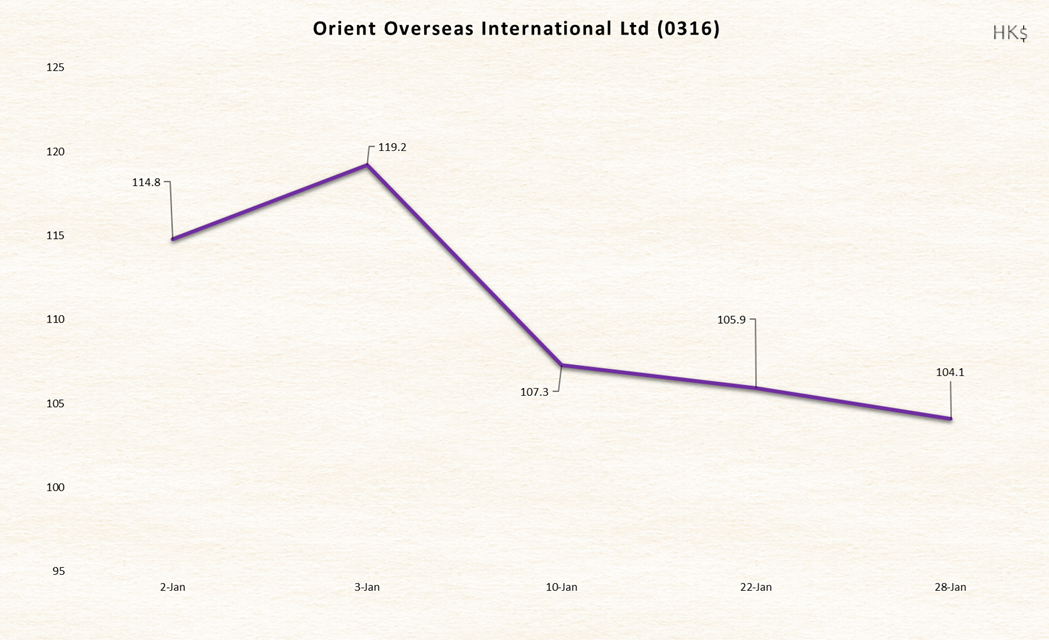

- Orient Overseas International Ltd (0316)

Orient Overseas International Ltd (0316) experienced a turbulent January 2025, with its stock price starting at HK$114.80. After an initial rise to HK$119.20, the mother company of Orient Overseas Container Line (OOCL) saw a significant decline to HK$107.30, further dropping to HK$105.90, then to HK$104.00, and finally settling at HK$104.01. This erratic movement might reflect industry-specific challenges or broader market volatility, with investors closely observing for any signs of a trend reversal.

- Matson Inc (MATX)

Matson Inc (MATX) had a varied month in January 2025, beginning at $137.82. The stock price slightly dipped to $136.59, then surged to $142.41, reflecting positive market sentiment or company developments. However, it fell back to $136.31 before stabilizing at $137.59. This volatility might be due to sector-specific dynamics or broader economic factors, with investors monitoring for continued stability or further shifts.

- Danaos Corporation (DAC)

Danaos Corporation (DAC) showed a slight decline in its stock price over January 2025. Opening at $82.90, it decreased to $79.48 and then to $78.21. A further drop to $76.71 was followed by a small rebound to $78.79 by month’s end. This fluctuation could indicate market adjustments or company-specific news, with investors keeping an eye on future trends.

- MPC Container Ships ASA (MPCC)

MPC Container Ships ASA (MPCC) experienced a downward trend in January 2025, starting at NOK 21.80. The stock saw a decline to NOK 19.09, further dipping to NOK 18.36 by mid-month, with a slight recovery to NOK 18.69 before closing at NOK 18.25. This movement suggests potential challenges within the sector or broader market influences, with investors watching for signs of recovery or further decline.

In January 2025, the container shipping sector experienced a month of significant losses, as evidenced by the performance of major companies. ZIM suffered the steepest decline at 27.54%, while Yang Ming and Hapag Lloyd also saw considerable drops of 11.49% and 11.46% respectively. Similarly, Maersk, MPCC, and Wan Hai recorded losses of 16.20%, 16.28%, and 8.25% respectively. SITC, COSCO, Danaos, Matson, OOIL, NYK Line, and MOL also faced declines

HMM, which showed a minor positive change of 5.31%, was the only company from the pool that avoided losses.

This widespread downturn indicates a challenging period for the industry, with investors likely concerned about the underlying causes and future recovery prospects.

![]()

The post Stock Monthly Report of Major Container Shipping Companies appeared first on Container News.

Content Original Link:

" target="_blank">