Global bunker indices show moderate decline

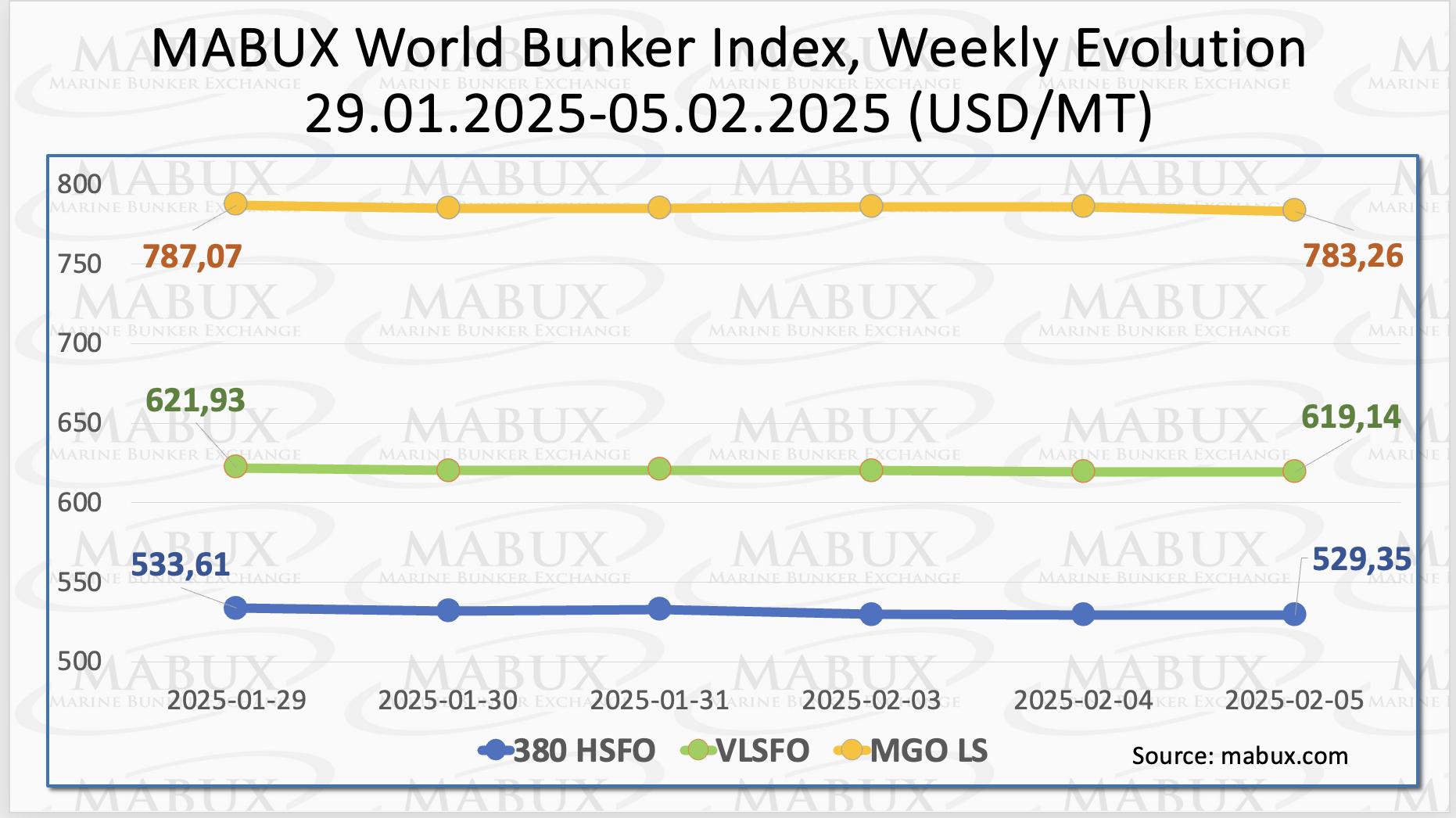

During the sixth week of the year, Marine Bunker Exchange (MABUX) indices experienced a moderate decline.

The 380 HSFO index dropped by US$4.26 to US$529.35/MT, the VLSFO index fell by US$2.79 to US$619.14/MT, edging closer to the US$600 threshold, while the MGO index declined by US$3.81 to US$783.26/MT.

“At the time of writing, the moderate decline in indices in the global bunker market continued,” stated a MABUX representative.

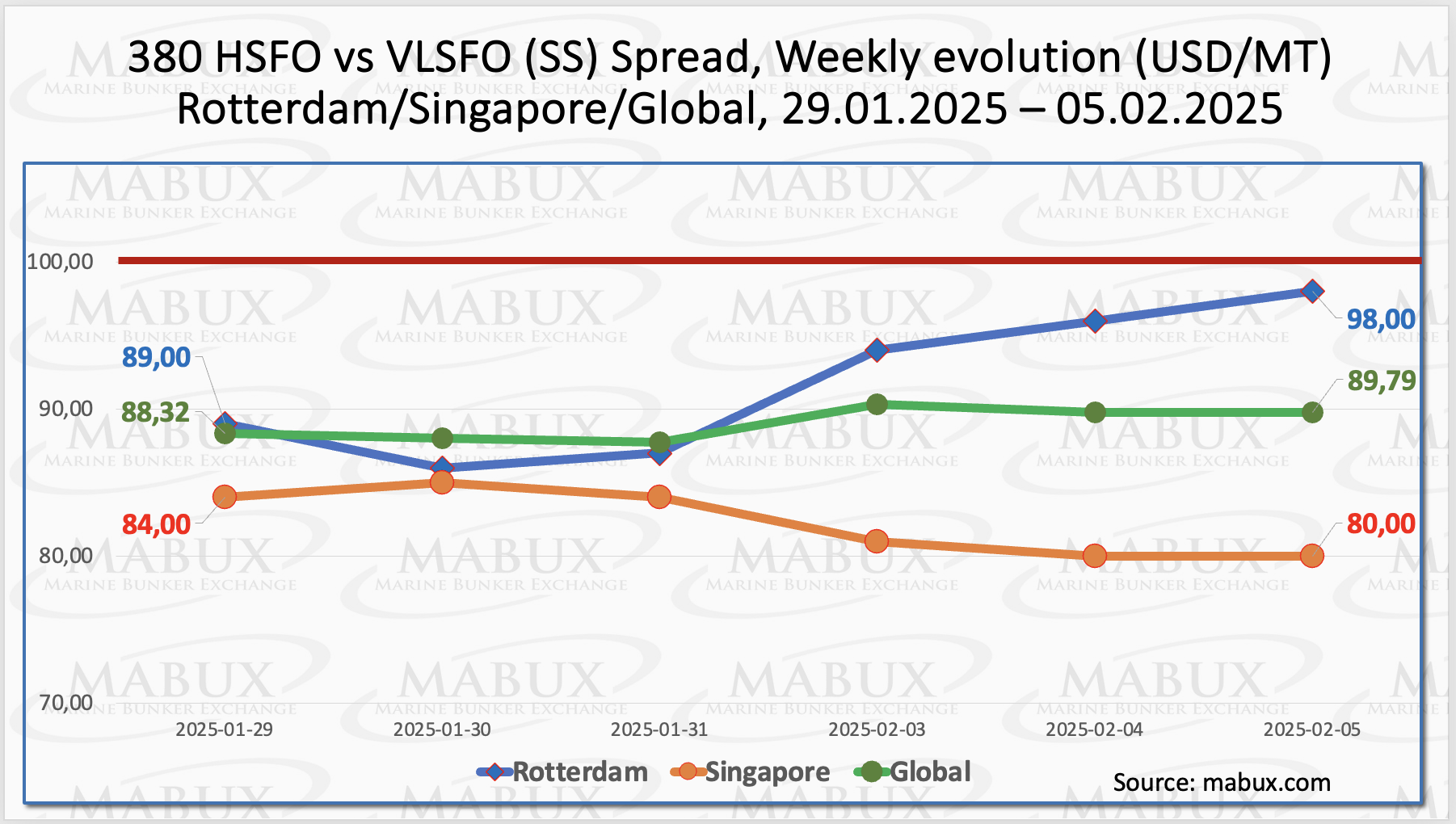

The MABUX Global Scrubber Spread (SS), representing the price difference between 380 HSFO and VLSFO, saw a slight increase, rising from US$88.32 last week to US$89.79, gradually nearing the US$100 SS breakeven point. The index’s weekly average also rose by US$3.32.

In Rotterdam, the SS Spread surged by US$9 over the week to US$98, with the port’s weekly average increasing by US$13.84. Conversely, in Singapore, the price gap between 380 HSFO and VLSFO narrowed by US$4 to US$80, while the weekly average declined by US$1.84.

Overall, the Global SS Spread and regional indices showed a gradual recovery toward SS breakeven levels, enhancing the cost-effectiveness of using 380 HSFO with a scrubber compared to VLSFO.

“We anticipate the SS Spread to continue its recovery next week,” said the MABUX official.

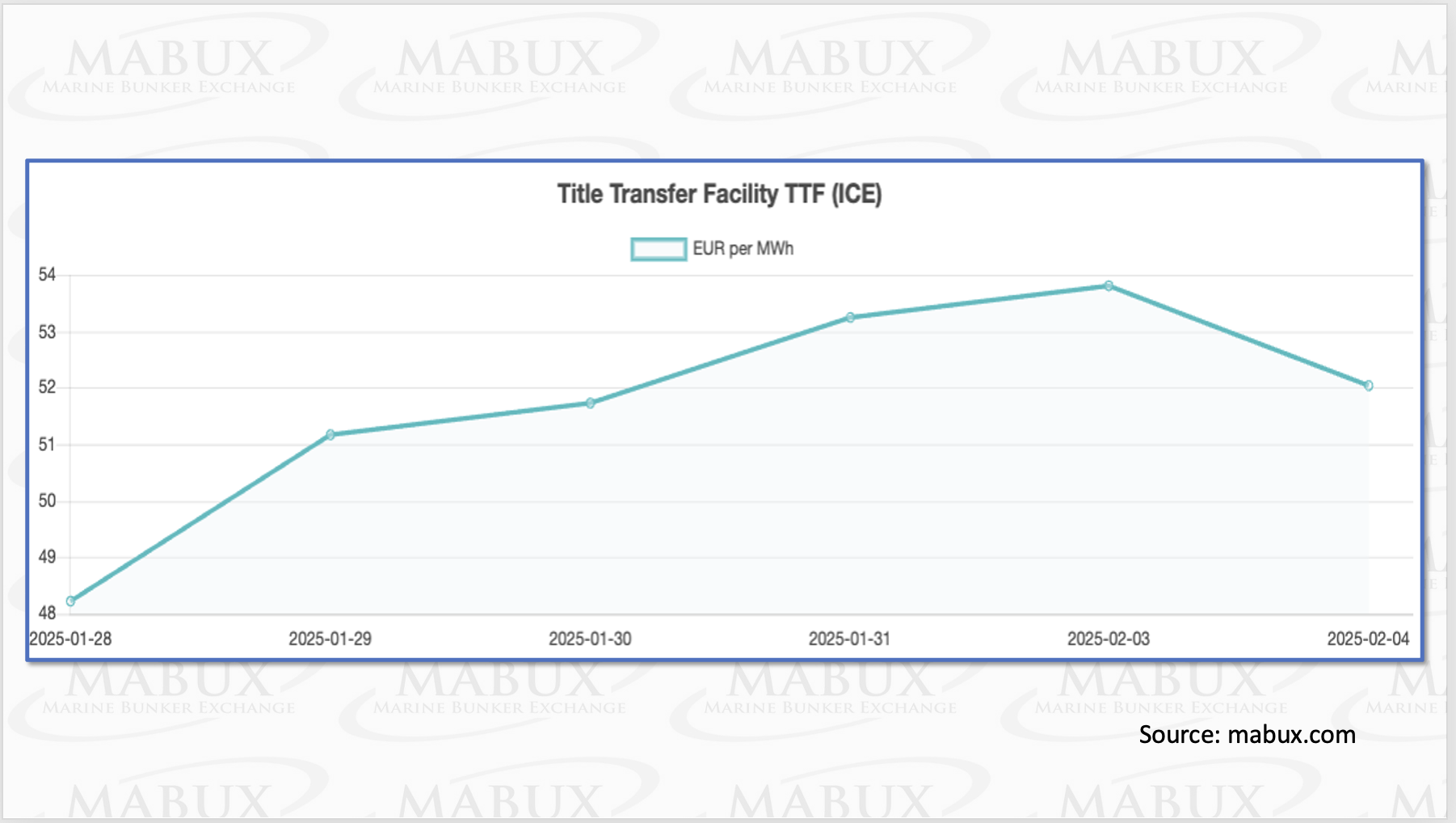

According to a statement, the European Union (EU) is considering extending mandatory natural gas storage targets for member states for at least another year beyond 2025. Since 2022, the EU has required storage levels to reach 90% capacity by November 1 each year.

Ahead of this winter, European gas storage facilities were around 95% full—equivalent to approximately 100 billion cubic meters (bcm) of gas, or a third of the EU’s annual consumption.

However, a colder winter, compared to the previous two milder ones, and prolonged low wind speeds in northwestern Europe have resulted in the fastest rate of gas storage depletion in eight years. As of 4 February, European regional storage facilities were 51.97% full, reflecting a decrease of 3.49% from the previous week and a drop of 19.36% since the beginning of the year.

The gas withdrawal process remains ongoing. At the end of the sixth week of 2024, the European gas benchmark TTF increased by €3.824/MWh, once again surpassing the €50/MWh threshold, reaching €52.048/MWh compared to €48.224/MWh last week.

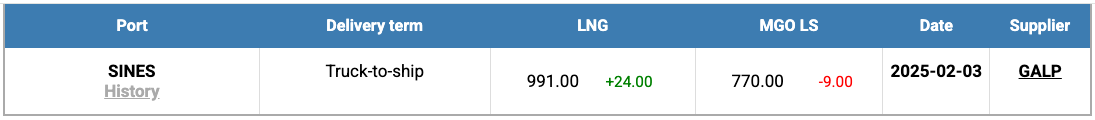

The price of LNG as a bunker fuel at the port of Sines (Portugal) increased by US$24 over the past week, reaching US$991/MT on 3 February. Meanwhile, the price gap between LNG and conventional fuel widened. On the same day, MGO LS was priced at US$770/MT, resulting in a US$221 difference in favour of MGO LS, up from US$188 the previous week.

During Week 06, the MABUX Market Differential Index (MDI), which measures the difference between market bunker prices (MBP Index) and the MABUX digital bunker benchmark (DBP Index), displayed mixed trends across the four major hubs: Rotterdam, Singapore, Fujairah, and Houston.

380 HSFO Segment: Singapore remained the only overvalued port, with its weekly average rising by 7 points. In contrast, Rotterdam, Fujairah, and Houston were undervalued. Margins declined by 2 points in Rotterdam and 14 points in Fujairah, while Houston recorded a 3-point increase.

VLSFO Segment: Rotterdam moved into the overcharge zone, joining Singapore. The weekly average rose by 16 points in Rotterdam and 6 points in Singapore. Meanwhile, Fujairah and Houston remained undervalued, with the index decreasing by 6 points in Fujairah but increasing by 1 point in Houston.

MGO LS Segment: Rotterdam and Singapore returned to the undervalued zone, making all four ports undercharged. The weekly averages increased by 13 points in Rotterdam, 7 points in Singapore, and 11 points in Houston, while Fujairah experienced a 10-point decline. The MDI indices in Rotterdam and Singapore remained near the 100% correlation mark between MBP and DBP, whereas Fujairah’s index once again dropped below the US$100 threshold.

“We anticipate that the global bunker market will continue to exhibit a potential moderate

downward trend next week,” stated Sergey Ivanov, Director of MABUX.

![]()

The post Global bunker indices show moderate decline appeared first on Container News.

Content Original Link:

" target="_blank">